In any SAP system (SAP ERP or SAP S/4HANA), there are two basic types of price control for materials: moving average price and standard price. In this blog post, we’ll discuss the differences between the two.

There are a few complex scenarios in which you could be purchasing different types of materials and dealing with goods receipts or invoice receipts in an SAP system. General ledger (GL) accounts are posted differently in the different cases, and the sequence of goods receipt and invoice receipt also increases the complexity. Sometimes, a big challenge that a finance team faces is to understand the financial document entries in the long purchase order (PO) history, and communicate them with other business teams. It is also a challenge to consultants to explain system logic to finance teams in such scenarios.

Before getting into too many details, let’s first discuss what their different meanings are.

Moving Average Price

Moving average price is an inventory costing method where the average price is calculated after obtaining the goods. The average cost of each inventory item in stock is re-calculated after every inventory purchase.

To calculate it, you would use this formula:

Moving Average Price = (Products On Hand Value + New Products Value) / Total Number of Products

The moving average price is a constantly recurring calculation, which could potentially change with each invoice or goods receipt.

Standard Price

Standard price is a predetermined price, and both receipts and issues will be valued at this price. It also remains constant for a certain amount of time, such as a quarter, a month, or some other timeframe. This method follows the standard costing technique of accounting, or the practice of substituting an expected cost for an actual cost in the accounting records. Subsequently, variances are recorded to show the difference between the expected and actual costs. Compared to collecting actual costs, standard costs could be used as a close approximation to actual costs and would have significant accounting efficiencies.

In the common practice, raw materials use the moving average price and semi-finished/finished products use the standard price.

If either the moving average price or standard price method is selected in the material master record, the SAP system just follows the accounting rules to do the inventory cost postings. The logic itself of moving average price or standard price is mainly the SAP standard function. Meanwhile, the system still needs some basic MM-FI integration configurations for GL accounts.

Example

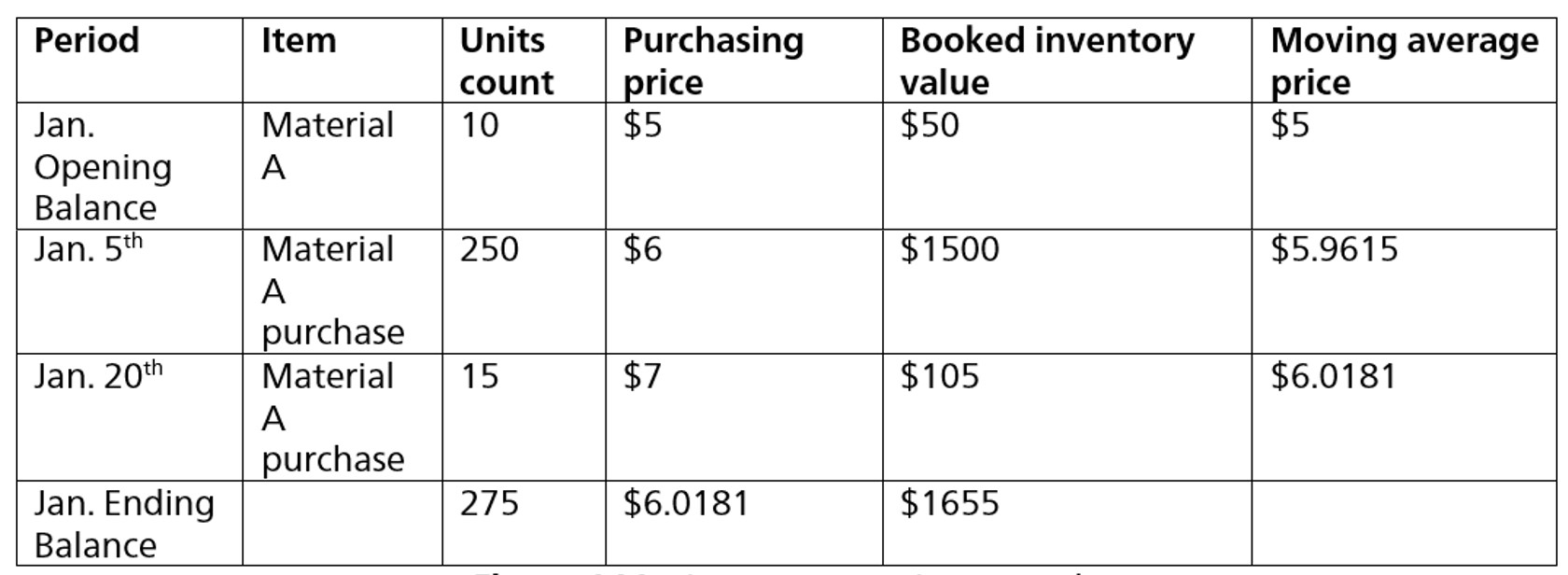

Let’s take a look at an example of how the SAP system proceeds using the moving average price.

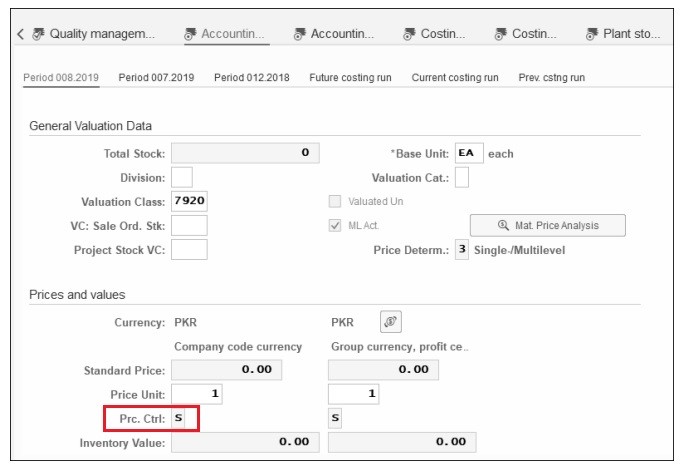

When the “V” value is selected in the price control field of the material master record, the system will use the moving average price method for this material. In the figure above, purchasing prices are different in each acquisition. The system would post an inventory balance based on each purchasing price, and update the latest moving average price in the material master record. Total stock and total value are also updated accordingly. Since goods issues are usually valued with the current moving average cost, they do not normally affect the inventory cost.

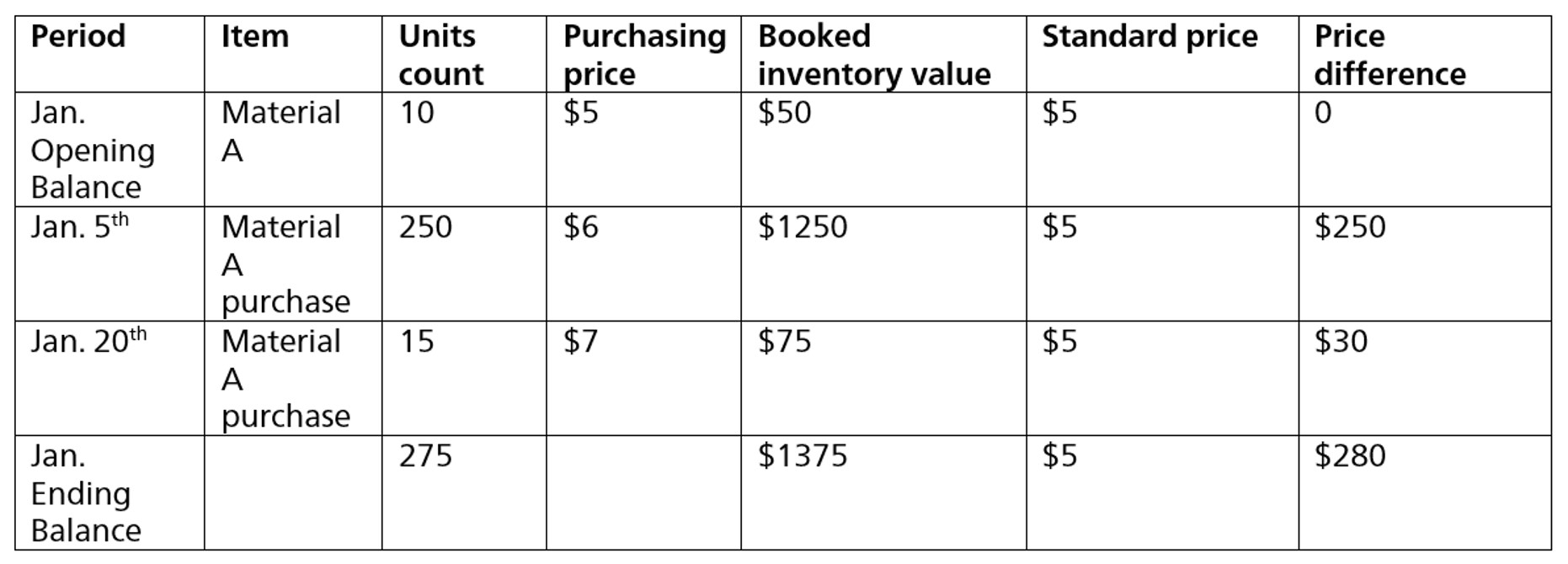

Compare this to the standard price example below.

**Booked inventory value = Standard Price * Units count

**Price difference = (Purchasing price – Standard price) * Units count

When the “S” value is selected in the price control field of the material master record, the SAP system will use the standard price method for this material. As shown in the standard price table above, even when purchasing prices are different, the system always uses the fixed standard price to post inventory balance in the given period. The differences between purchasing price and standard price are posted to a price difference account. Total stock and total value are also updated by standard price in material master record. In this case, goods issues are usually valued with the standard price.

Business Scenarios

Now, let’s get into detail about some business scenarios in the PO purchasing process, showing the differences between moving average price and standard price.

Let’s discuss moving average cost scenarios first. Moving average cost mainly has two scenarios, which are material with moving average price (MAP) with stock coverage and material with MAP without stock coverage.

Material with MAP with Stock Coverage

The business background: At the beginning of its January 1st fiscal year, a company reports a beginning inventory of 100 units at a cost of $1.20 per unit. Over the first quarter, the company purchases of 100 units at a cost of $1.30 on January 15th. The invoice shows $140 total amount.

The PO unit price is $1.30 and the PO quantity is 100 pieces. Depending on the sequence of goods receipt (GR) and inventory receipt (IR), the double entry of financial documents would be a little different. The material with “V” value in the price control field has a moving average price of $1.20/piece initially.

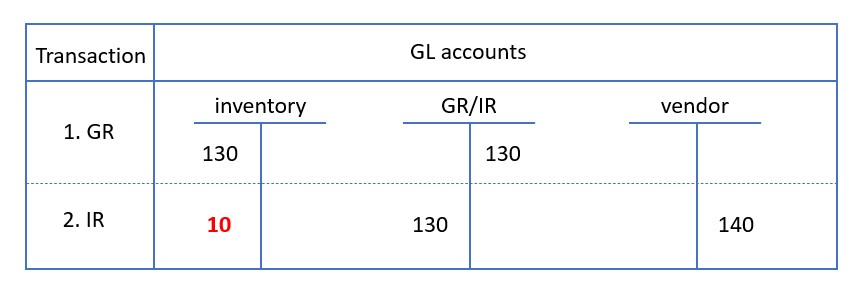

If the earlier than the invoice receipt, GR posts an inventory balance based on the PO unit price. The stock adds 100 pieces. Then, the company receives the invoice. The IR posts a total of $140 to the vendor account in the credit side. The GR/IR clearing account is cleared based on the purchase order price. The total variance $10 between the PO price and invoice price is posted to the debit side of the inventory account. Then the total balance of inventory is $140. The figure below shows the full document double entry in the GR and IR posting steps.

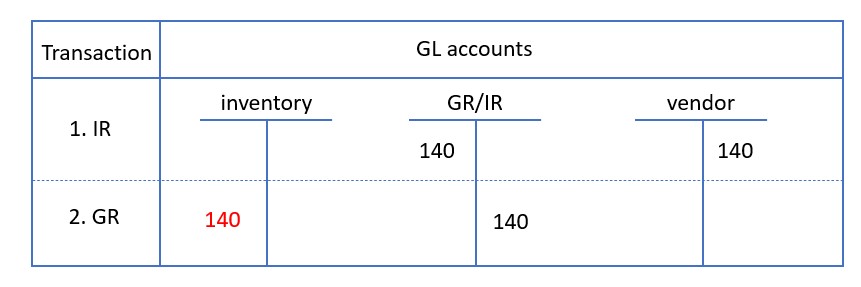

If the invoice receipt is posted before the goods receipt, the invoice price becomes the basis for the posting. The goods receipt that follows is posted with the value posted at the invoice receipt.

In this case, IR posts the invoice total amount of $140 to the vendor account and GR/IR account. Then, the company receives the goods and posts $140 to the inventory account with the invoice price. The GR/IR account is also cleared with the invoice price. The total balance of inventory is also $140. This figure shows the full document double entry in the IR and GR posting steps.

Material with MAP without Stock Coverage

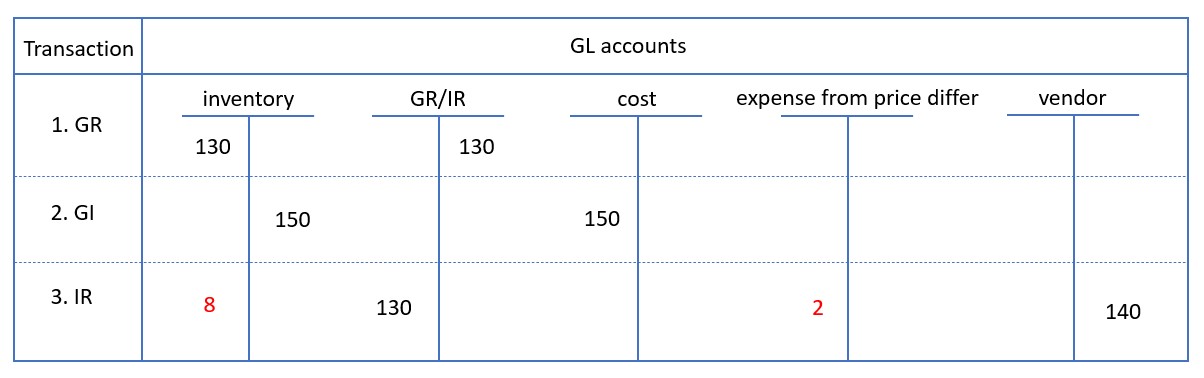

If the stock of a material is less than the quantity specified in the invoice because goods were withdrawn between GR and IR, the stock account is only debited or credited for the actual stock. The remaining amount is posted to a price differences account.

Suppose the general business background is the same as the above and is using the moving average price. The only difference in reporting is that there is a goods withdrawal with quantity 120 pieces from the total quantity of 200 pieces between GR and IR. The latest moving average price is $1.25 at the time of this withdrawal. $150 is posted to the credit side of inventory. The $10 variance between the PO price and invoice price is divided into two parts. Since only 80 pieces of the material are in stock at the time of invoice receipt, the price difference is debited with $8 to the material for 80 pieces only. The remaining $2 is posted to expense from price difference. This figure shows the full document double entry.

Standard Price Scenario

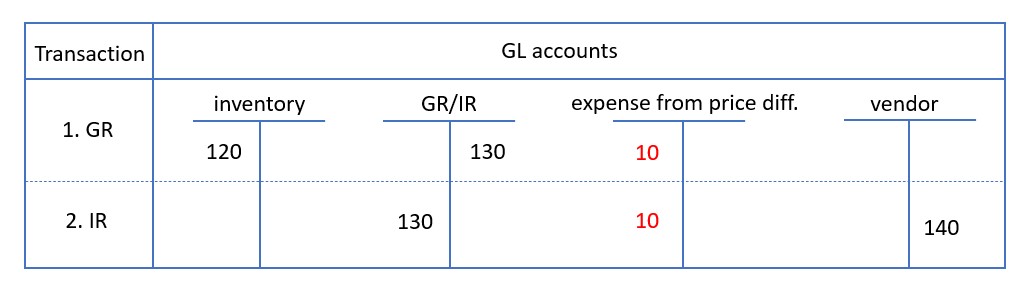

Let’s keep the same business scenario using the standard price option. The difference is that the price control of the material selects the “S” value, which uses a standard price of $1.20/piece initially.

As shown in the figure below, GR comes before IR. The GR posts inventory with the standard price, while GR/IR is posted based on PO price. The variance of $10 between GR and PO price is posted to expense from a price difference account. Then, IR posts the total invoice of $140 into the vendor account. GR/IR is cleared based on PO Price. The variance of $10 between the IR and PO price is posted into the debit side of expense from the price difference account.

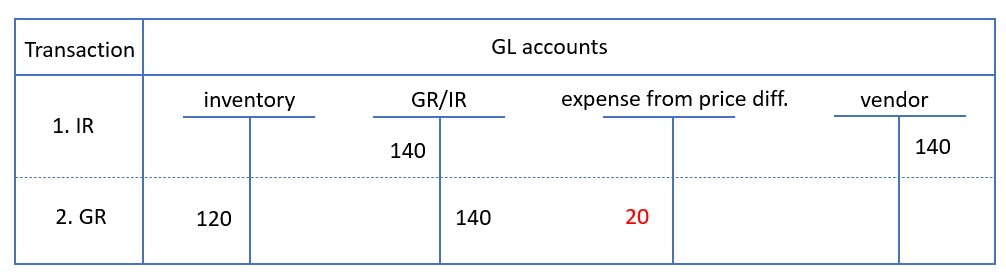

As shown in the final figure, IR comes earlier than GR. IR posts the total invoice of $140 into vendor account. GR/IR is then posted based on invoice price. Then, GR posts inventory with the standard price. GR/IR is cleared based on the invoice price. The variance of $20 between the IR price and standard price is posted into the debit side of expense from the price difference account.

In other cases, if the PO price is less than standard price, or the invoice price is less than the PO price, revenue account from price difference would be posted instead of expense from price difference.

Conclusion

Inventory cost calculation in SAP S/4HANA is a fundamental piece of functionality that can help companies manage inventory well. It is important to have a deep understanding of the scenarios based on the sequence of goods receipt and invoice receipt. In this post, we talked about the two basic types—moving average price and standard price—and how they behave in an SAP system.

Source: https://blog.sap-press.com/what-is-the-difference-between-moving-average-price-and-standard-price-in-sap?utm_campaign=Blog&utm_content=245016330&utm_medium=social&utm_source=linkedin&hss_channel=lcp-5358203