now that you’ve read my previous post “Tax Substitution – ICMS ST“, it is time to see this working on SAP.

This is not the ONLY way to do that. There are other ways… this is one of them…

I – Configuration

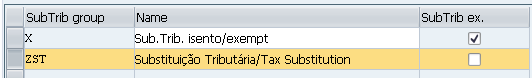

1) Define Customer Group for Tax Substitution Calculation

This activity is not mandatory but it is recommended, so you can grouping characteristic for customers who are subject to the same tax calculation for ‘Substituiçao Tributária’.

This activity is not mandatory but it is recommended, so you can grouping characteristic for customers who are subject to the same tax calculation for ‘Substituiçao Tributária’.

SPRO > Financial Accounting > Financial Accounting Global Settings > Tax on Sales/Purchases > Calculation > Settings for Tax Calculation in Brazil > Define Customer Groups for SubTrib Calculation

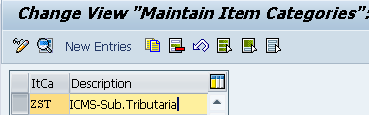

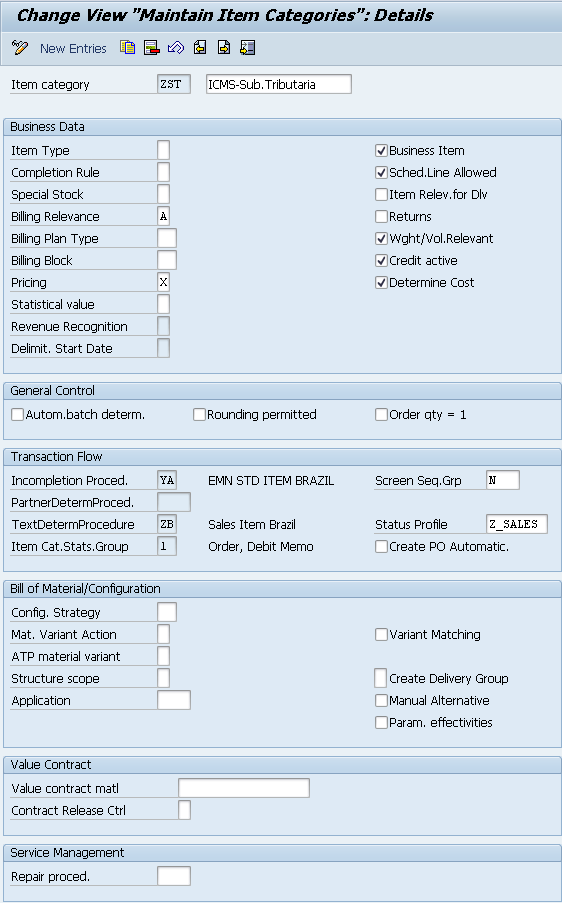

2) Define Item Categories

Here you will create an item category that will be assigned to the Sales Order and it will be used to call the correct tax information. With the new Item Category, you don’t need to have one Sales Order type only for tax substitution.

Here you will create an item category that will be assigned to the Sales Order and it will be used to call the correct tax information. With the new Item Category, you don’t need to have one Sales Order type only for tax substitution.

SPRO > Sales and Distribution > Sales > Sales Documents > Sales Document Item > Define Item Categories

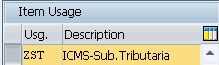

3) Define Item Category Usage

SPRO > Sales and Distribution > Sales > Sales Documents > Sales Document Item > Define Item Category Usage

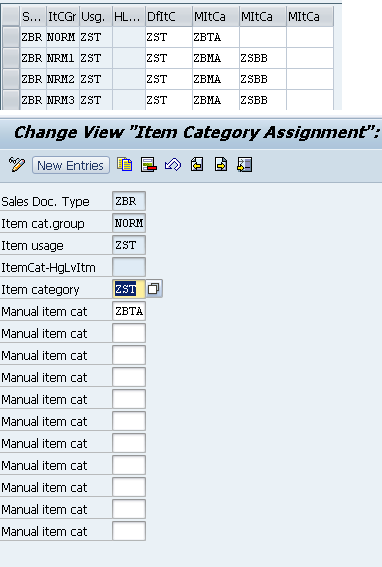

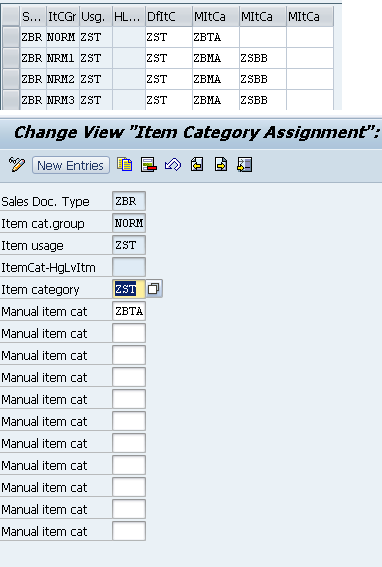

4) Assign Item Categories

SPRO > Sales and Distribution > Sales > Sales Documents > Sales Document Item > Assign Item Categories

Using your standard sales order type as reference, add a new entry following the example below adding the ZST Item Category and the ZST Item Usage:

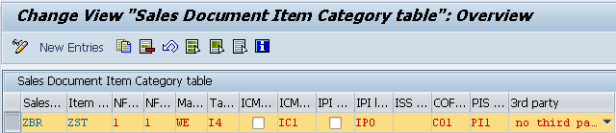

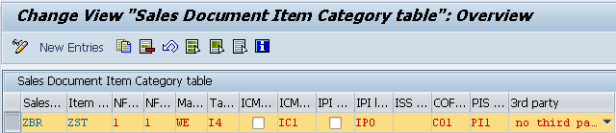

5) Maintain Sales Document Item Category

SPRO > Sales and Distribution > Billing > Billing Documents > Country Specifics Features > Brazil > Maintains Sales Document Item Category

Using your standard sales order type as reference, add a new entry following the example below assigning the ZST Item Category and the taxes information.

The table above is the famous (or infamous) J_1BSDICA table.

This table has 2 key fields: Sales Order Type and Item Category and they are used to assign the Nota Fiscal Type, ICMS, IPI, PIS and COFINS Text/Tax Laws, Tax Code, CFOP and etc.

If you are not familiar with this table, I may write a post to explain better how that works, but what you need to know is that:

a) Sales Document Type – Type the Sales Order type that it is used for standard/regular sales

b)Item category – Type the Item Category that you created in the steps above (ZST in this example)

c) NF Item Type – Type “1” for Standard Item

d) NF CFOP Special Case – Type “1” for CFOP Determination with Substituicao Tributaria

e) Main partner id – Enter the Ship To Partner Type

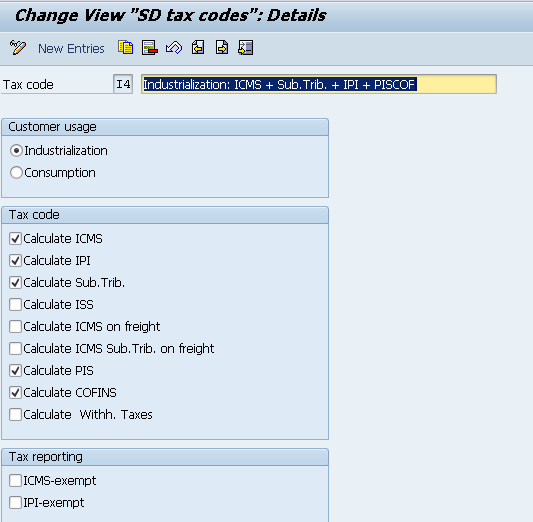

f) Tax code – I4 (or the tax code that you will use to calculate ICMS + ICMS-ST + IPI + PIS + COFINS

g) ICMS law – Inform the ICMS Tax Law (Domicilio Fiscal, Text Law). You may have one standard tax law for ICMS ST that states the law when selling products with Tax Substitution. For dynamic exceptions, as the Tax Substitution Dynamic Exception doesn’t have the Text Law field, you can use the Customer Master Records to assign a different text law or the Regular ICMS Dynamic Exceptions table for that

h) IPI law – Inform the IPI Tax Law (Domicilio Fiscal, Text Law), for instance, the same IPI Text Law as assigned to the regular sales

i) COFINS Law – Inform the COFINS Tax Law (Domicilio Fiscal, Text Law), for instance, the same COFINS Text Law as assigned to the regular sales

j) PIS Law – Inform the PIS Tax Law (Domicilio Fiscal, Text Law), for instance, the same PIS Text Law as assigned to the regular sales

6) Maintain SD Tax Codes

SPRO > Financial Accounting (New) > Financial Accounting Global Settings (New) > Tax on Sales/Purchases > Calculation > Settings for Tax Calculation in Brazil > Define SD Tax Codes

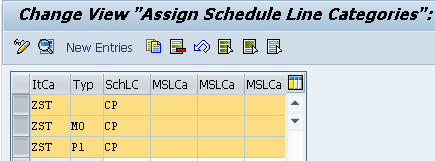

7) Assign Schedule Line Categories

SPRO > Sales and Distribution > Sales > Sales Documents > Sales Document Item > Schedule Lines > Assign Schedule Line Categories

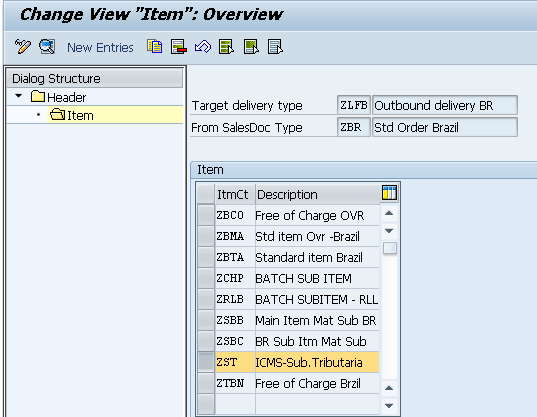

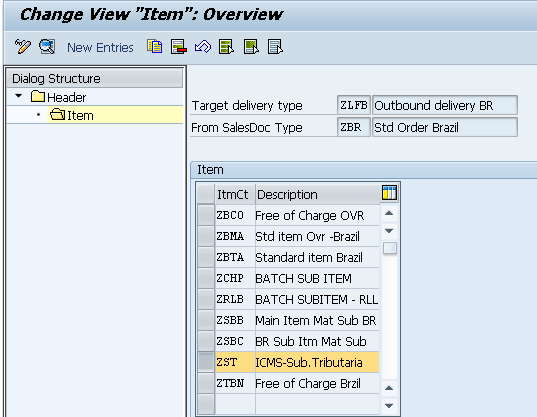

8) Maintain Copy Control Settings Sales Order to Delivery

SPRO > Logistics Execution > Shipping > Copying Control > Specify Copy Control for Deliveries

Add a new entry, following the example below and change the combination of Sales Order Type and Delivery Type to the document types that you are using for your regular sales.

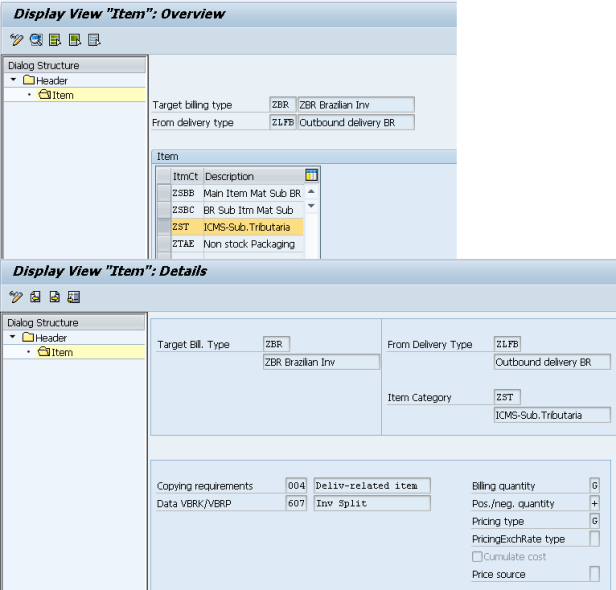

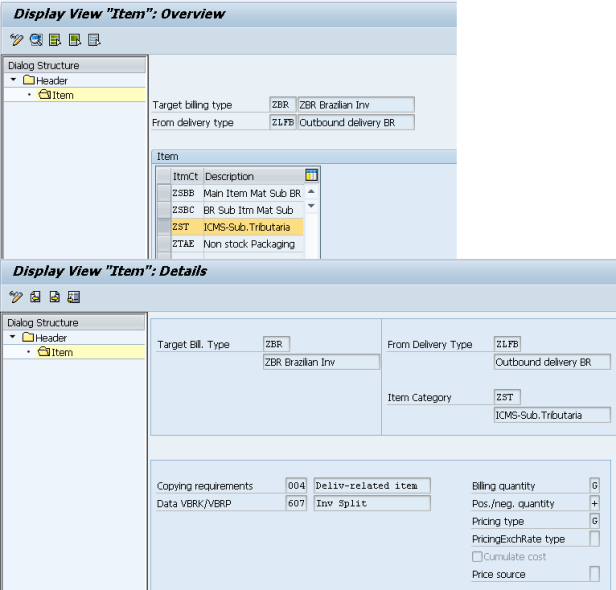

9) Maintain Copy Control Settings Delivery to Billing Document

SPRO > Sales and Distribution > Billing > Billing Documents > Maintain Copying Control For Billing Documents > Copying control: Delivery document to billing document

Add a new entry, following the example below and change the combination of Delivery Type and Billing Document to the document types that you are using for your regular sales.

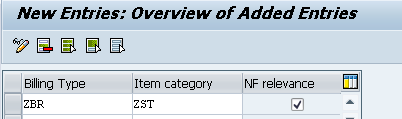

10) Maintain Billing Document Item Category

SPRO > Sales and Distribution > Billing > Billing Documents > Country-specific Features > Country-specific Features for Brazil > Maintain Billing Document Item Category

II – Taxes Exception and Customer Info Records

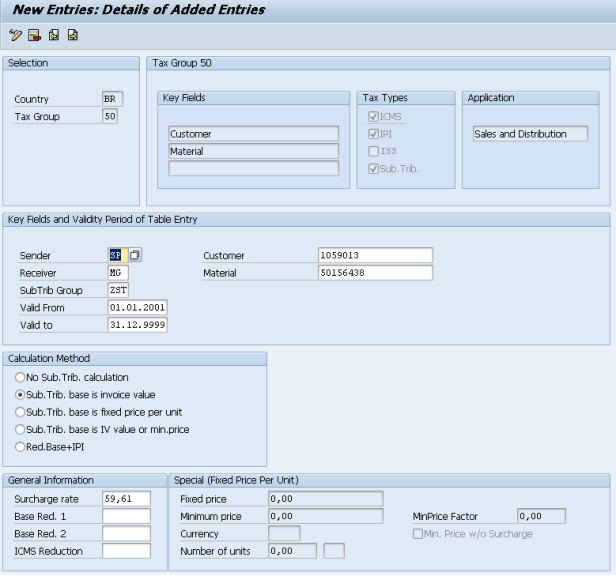

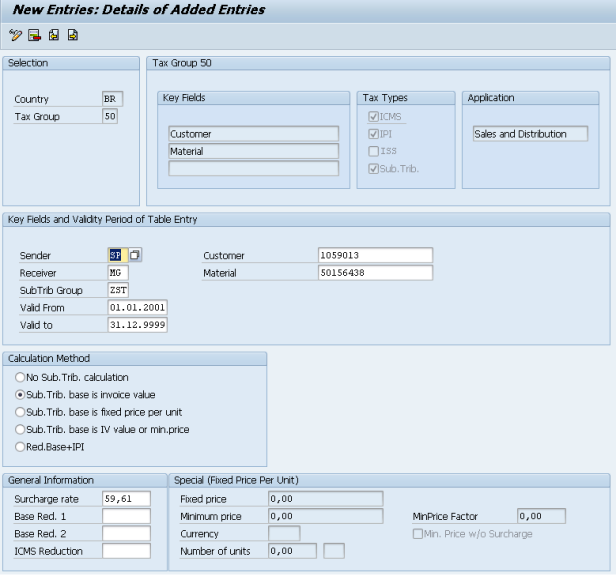

11) Maintain SubTrib Dynamic Exceptions

Here you will maintain the Dynamic Exception to calculate ICMS ST with the correct MVA (Surcharge) and also the calculation method.

Here you will maintain the Dynamic Exception to calculate ICMS ST with the correct MVA (Surcharge) and also the calculation method.

This maintenance has to be done at the client level. You can check more details about it on my post: Change Customizing Tables to Master Data Tables

You can maintain the Tax Exception via transaction S_PL0_09000292 or following the path below:

SPRO > Financial Accounting > Financial Accounting Global Settings > Tax on Sales/Purchases > Calculation > Settings for Tax Calculation in Brazil >Tax Rates > Maintain SubTrib Dynamic Exceptions

You can also go to transaction J1BTAX and at the main screen double click at Maintain SubTrib Dynamic Exceptions (J_1BTXST3).

You can pick any tax group that fits your needs, I did select the combination of Customer and Material (here represented as group 50). If you are not familiar with tax groups, check the following posts:

In this screen, you have to inform:

– Sender (Ship From) – Region/State where the goods are leaving (comes from Plant Master Data)

– Receiver (Ship To) – Region/State where the goods will be delivered (comes from Customer Master Data)

– Sub.Trib Group (Optional, if you have assigned it to the Customer Master, then you have to inform it here)

– Valid From – Date when the tax exception will be in place

– Valid To – Ending date to the tax exception

– Dynamic Key 1 – Customer – Here, the keys can be anything you think it will fits better your business, it can be customer the parameter, but it can also be any key as explained on the postings mentioned above.

– Dynamic Key 2 – Material – Same concept as above.

– Dynamic Key 3 – To this group 50, I am not using a 3rd key.

– Calculation Method – You can have from No ST Calculation to Different ways to calculate it. Check with tax department the correct method to the specific ICMS ST Calculation. In this example, I am assuming that the ICMS ST is calculated based on the total invoice amount including taxes.

– General Information – Depending on the calculation method, the fields in this section will be available or not. In this example, I will inform that the calculation has a surcharge rate (MVA) of 59,61%

– Sender (Ship From) – Region/State where the goods are leaving (comes from Plant Master Data)

– Receiver (Ship To) – Region/State where the goods will be delivered (comes from Customer Master Data)

– Sub.Trib Group (Optional, if you have assigned it to the Customer Master, then you have to inform it here)

– Valid From – Date when the tax exception will be in place

– Valid To – Ending date to the tax exception

– Dynamic Key 1 – Customer – Here, the keys can be anything you think it will fits better your business, it can be customer the parameter, but it can also be any key as explained on the postings mentioned above.

– Dynamic Key 2 – Material – Same concept as above.

– Dynamic Key 3 – To this group 50, I am not using a 3rd key.

– Calculation Method – You can have from No ST Calculation to Different ways to calculate it. Check with tax department the correct method to the specific ICMS ST Calculation. In this example, I am assuming that the ICMS ST is calculated based on the total invoice amount including taxes.

– General Information – Depending on the calculation method, the fields in this section will be available or not. In this example, I will inform that the calculation has a surcharge rate (MVA) of 59,61%

12) Maintain Customer Master Records

Add the SubTrib Group to the customer. The usage of the SubTrib Group is usefull if you ahve a group of customers that falls under the same ICMS ST Rules, then you can create taxes exceptions based on the SubTrib group instead individually.

Add the SubTrib Group to the customer. The usage of the SubTrib Group is usefull if you ahve a group of customers that falls under the same ICMS ST Rules, then you can create taxes exceptions based on the SubTrib group instead individually.

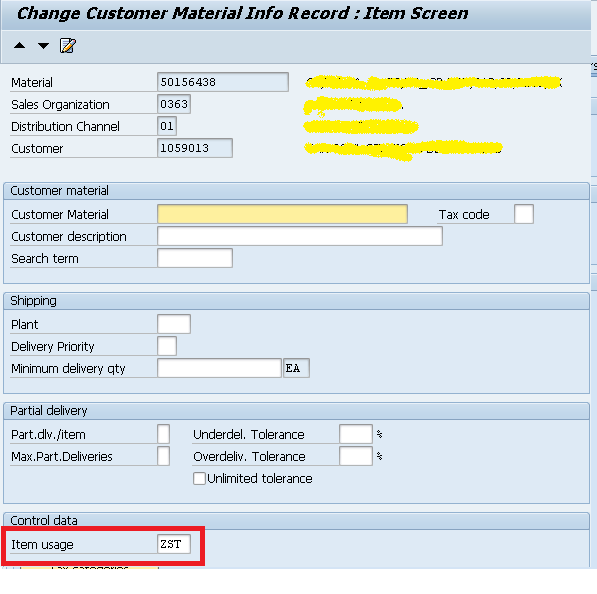

13) Maintain Customer Master Info Records (CMIR)

To a combination of customer and material, create Create a CMIR at VD51/VD52 to assign the Item Usage at sales order as ZST.

To a combination of customer and material, create Create a CMIR at VD51/VD52 to assign the Item Usage at sales order as ZST.

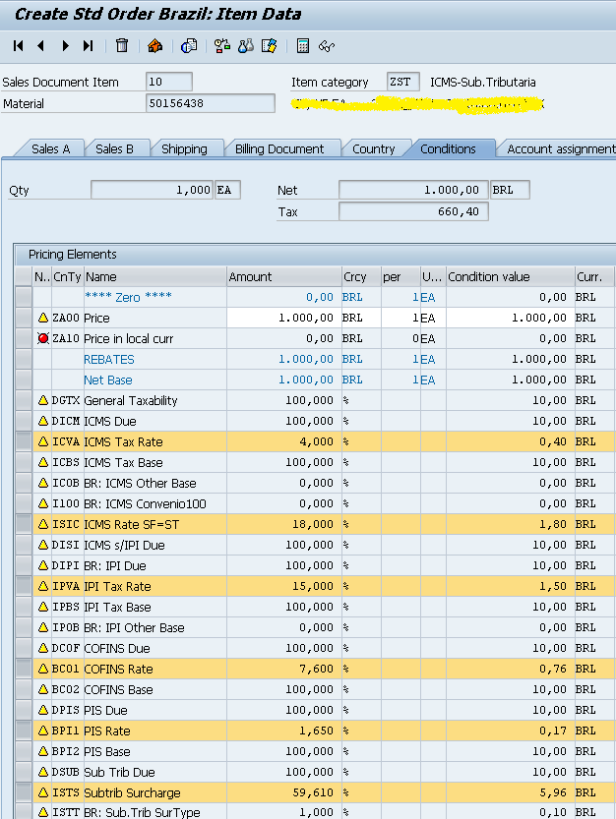

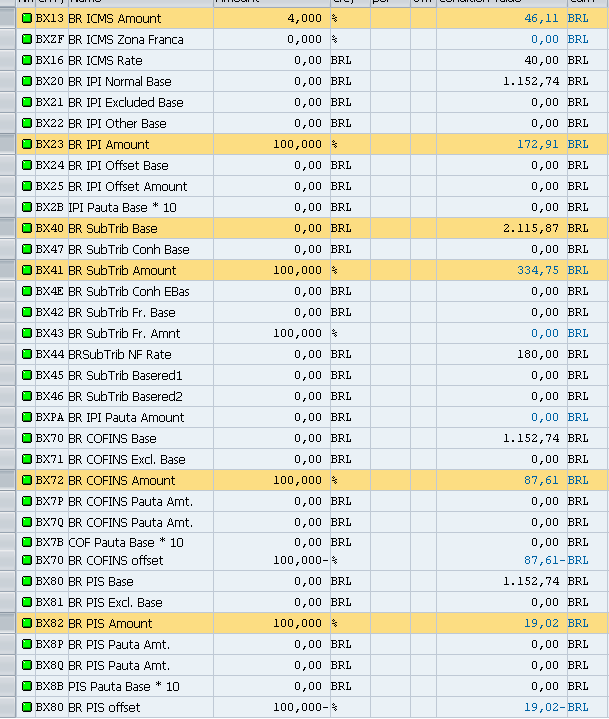

III) Test and Results

Calculation:

| % ICMS Rate | 4% |

| % IPI Rate | 15% |

| ICMS Amount | 46.11 |

| IPI Amount | 172.91 |

| Total NF Amount (with taxes ICMS+IPI) | 1325.65 |

| Amount with ICMS only | 1152.74 |

| Net Amount | 1106.63 |

Tax Substitution

| |

| % ICMS Surcharge Rate (MVA) | 59.61 |

| % ICMS Receiver Rate (2°) | 1800% |

| ICMS ST Calculation Base | 2115.87 |

| ICMS ST Amount | 334.75 |

| NF Total AMount (ICMS+IPI+ICMS ST) | 1660.40 |

| % PIS Rate | 1.65% |

| PIS Amount | 19.02 |

| % COFINS Rate | 7.60% |

| COFINS Amount | 87.61 |

| Stock Value | 1000.00 |

Based on the configuration and the combination of Customer Master Infor Records + Taxes Dynamic Exception, the Sales Order did pull the Item Category ZST, the correct Tax Code(I4 for instance), the correct CFOP, Taxes Law and the calculation as below:

Well… that’s it… I hope you enjoyed reading as much as I did enjoy writing…

If you thought this post helpful, if you have a comment, or if you want share some experience, leave a comment here…

Fonte: https://sapbr.com/2015/01/28/configuring-tax-substitution-icms-st/

Nenhum comentário:

Postar um comentário