This blog was designed for SAP solution architects and Global IT members that are studying a future SAP rollout to Brazil or the conversion/implementation of S/4HANA to replace ECC or legacy ERP systems.

Revision 2024: This blog post was originally written in 2020 for the SAP Community and has been updated to the latest information about the solutions.

In first place I like to discuss and analyze what’s the best strategy for doing a rollout to Brazil in terms of technical architecture and business process to cover both the business requirements as well as the technical requirements.

I tell all my customers, there is no “silber bullet” to implement SAP in Brazil because it all depends on the company strategy, processes, its industry and its business requirement, the idea of the blog posts is to provide recommendations and highlight pros and cons of each approach so you can make a more informed decision.

The focus of this analysis is in the impact of Brazilian Localization in the system, I’ll focus in the topics around Quote-to-Cash and Procure-to-Pay (basically SD, MM and FICO).

I also do not plan to discuss specific details of the scope item configuration for Brazil (as there many differences to other countries) but rather focus on the main topics on the architecture, the necessary add-on’s or 3rd party systems and how it all impacts project decisions.

With the trends on digital transformation and agile implementation projects it’s normal to question the processes, developments and new needs contemplated in the Brazil localization in S/4HANA.

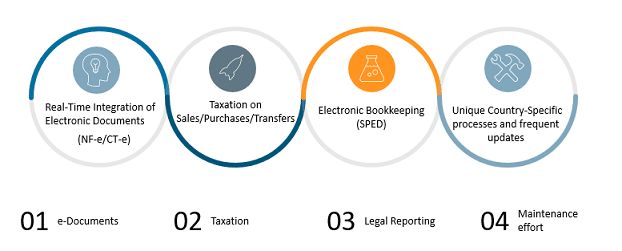

Main Challenges to implement SAP in Brazil

The main country-specific challenges to do an SAP ERP Rollout to Brazil with SAP S/4HANA continue to be the same that we had in SAP ECC:

- 1. Real-Time Integration of Electronic Documents such as outbound and inbound invoices (NF-e) and Freight bills (CT-e) into Quote-to-Cash and Procure-to-Pay.

- 2. Very complex taxation on sales/purchases

- 3. Complex legal reporting (SPED electronic bookkeeping reports) with several national, state and city level reporting with different layouts and very high level of details

- 4. High Maintenance/Administration effort for IT to create new document types, new settings and ensure data can be consolidated into a useful manner for group reporting and performance comparison as well as for process adherence with headquarters template

There are many other implications of Brazil localization with impact in FICO (Country Specific Reference Chart of Accounts for legal reporting, Additional GL accounts needed for specific taxes, Bank Statement formats based on Febraban Standards, Instant Payments with PIX, Actual Cost calculation at Month-End Closing with Material Ledger) but these types of requirements are more common in rollouts to other countries and will not be part of this article. There are other types of impacts also in production/inventory (due to legal reporting), in HR (payroll is completely localized), in Travel and Expenses but the focus of the series will remain in the FICO, SD, MM topics.

Added to the country-specific requirements there are still other project and technology challenges that come from new deployment model possibilities (Public Cloud, Private Cloud or On-Premise) and Business Process Management, namely how to handle the Global Template, how to balance business requirements, legal requirements and company global/local processes.

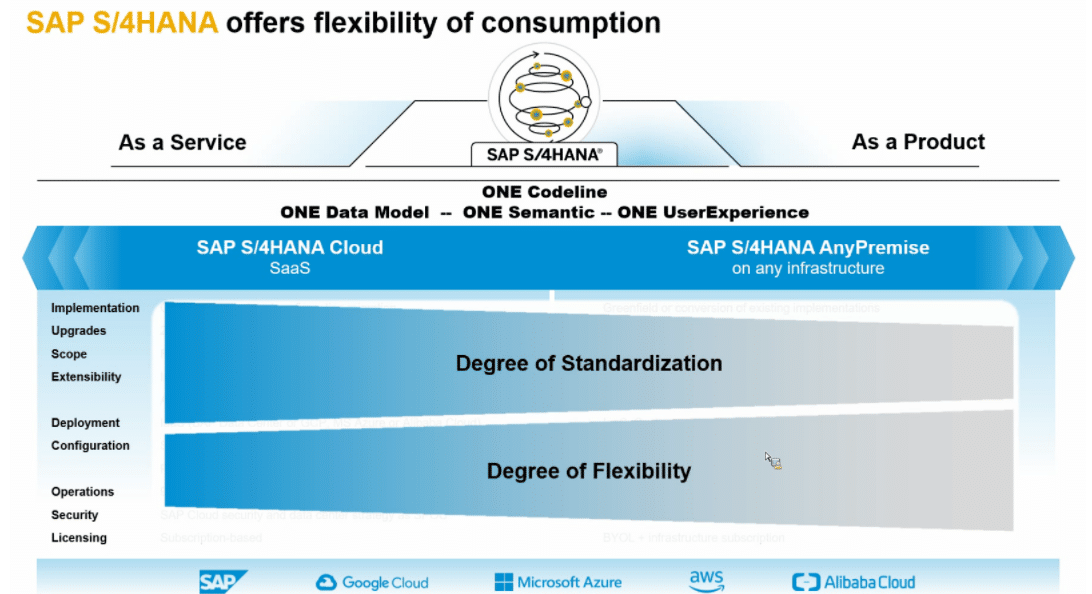

Deployment possibilities for Brazil S/4HANA implementation

There is an interesting blog from SAP that explains the difference between the different capabilities and functionalities available in the different deployment possibilities of SAP S/4HANA cloud and on-premise deployment options.

Source of Image: SAP

I’ll highlight specific points related to Brazil country specific features that I consider relevant:

S/4HANA Private Cloud (RISE/GROW) and On-premise

That’s the most traditional deployment (although SAP is pushing public cloud solutions to become the go-to for new customers) for S/4HANA so far as the majority of the customers in Brazil use that. Frankly, for customers that already use ECC, I find it quite hard to consider using S/4HANA Public Cloud. Specially due to extensive developments needed in the areas of taxation and NF-e, besides classic BadI’s it’s common to have implicit enhancements and Z programs to cover functionalities not delivered by SAP in the standard software, this is only possible withing On-Prem/Private Cloud, to achieve similar things in Public Cloud it would require many more new developments and extensions.

The main advantages of the Private Cloud/On-Premise for Brazil are:

- Keeping the schedule of changes totally under the company control – SAP publishes correction notes frequently for XX-CSC-BR* components and sometimes they contain critical updates needed for allowing invoices to be issued correctly

- Allowing all enhancement techniques – some country-specific features are not supported by SAP and they require extensive usage of “implicit enhancements” in localization function modules and classes/methods. On the downside it requires higher administration and IT efforts to be maintained and generally cause higher complexity for upgrades and system updates.

- Make developments using classic technologies (although some of them are not aligned with the clean core concept) that the Global IT team is already used to implement and support.

S/4HANA Public Cloud

SAP released Brazil localization for S/4HANA public cloud for several industries and there are customers already live with it in Brazil. The current SAP documentation for S/4HANA cloud Brazil is found in the following link: S/4HANA Cloud Brazil (2402)

In my opinion S/4HANA Cloud seems an interesting solution mainly for companies that are primarily service providers (with less complex taxation requirements), start-up’s looking for an scalable back office (Sales, Finance/Controlling and Procurement) ERP and also for companies that have subsidiaries with smaller or less complex operations (only administration/sales office without own-production) where they’ll not need the full scope of complex operations (Production, Supply Chain, Transportation Management, Import/Export).

I mean it specially for service companies as the service tax in Brazil is less complex than the taxes for goods and also the legal requirements due for service companies are easier to be implemented.

It’s also possible to implement the public cloud ERP in other industries with more processes but then it will require more extensions to be developed in SAP BTP or in 3rd party applications to complement scenarios that are not available directly in the scope items of the ERP. Here it really requires a completely different mentality for IT Team, focusing really only on must-have functionalities and embracing new ways of making developments and extensions.

The public cloud also enforces the usage of FIORI and UI5 apps through the browser and no SAP GUI options, so long-time users of SAP usually have a hard-time accepting the new User Interfaces.

SAP is focusing more and more in cloud solutions so new functionalities for Brazil localization are usually released for Public Cloud first and later on (once a year) for the On-Premise Versions. There are already cases of functionalities created only for Public cloud and not ported to the Private Cloud/On-Prem. In the rest of the article when I discuss the specific BR challenges I’ll highligh differences in approach for On-Prem/Private Cloud and Public Cloud.

All in all, a Hybrid approach for SAP S/4HANA rollout to Brazil makes sense

Considering my opinion independently of using S/4HANA Private Cloud or on-Prem the best strategy for the Brazil rollout is a hybrid-landscape approach, where the company will connect the SAP ERP to other cloud applications for Invoicing, Reporting, Taxation and more depending on its requirements and scenarios to be implemented. Trying to handle everything as local developments inside S/4HANA can become a problem for operations when there are frequent legal changes and global IT is focused in other projects/demands.

An on-Premise S/4HANA system can be “plugged” into cloud-based solutions such as NF-e solutions or Tax as a Service and other products in SAP BTP depending on customer requirements and that’s my recommendation for almost all companies.

So even for those that use on-premise S/4HANA the best way, in my humble opinio, to handle the necessary add-on’s and interfaces right now seems to be by adopting cloud solutions that integrate with S/4HANA, that saves companies from the issues of buying hardware, managing installations of technical components and supporting all of them over time.

This Hybrid-Landscape apporach reduces the needs of maintenance by IT and ensure that frequent updates are implemented in the cloud systems ( according to legal requirements ) without changing much the core ERP functionalities and creating additional work for global IT.

That provides an option to reduce administration effort of country specific features for companies that still want to maintain a Private Cloud/On-Premise ERP installation.

The SAP ERP Rollout to Brazil with SAP S/4HANA is a complex project and it requires cross-department effort and support from Global and Local IT together with Business Stakeholders from subsidiary and headquarters. So no easy way to do it, it takes time to learn the ways of localization and its trickiest parts.

In the next blog posts I’ll deep dive into each of 4 different challenges mentioned before:

- 1. Electronic Documents

- 2. Complex Taxation

- 3. Electronic Legal Reporting

- 4. Unique processes and frequent legal changes

That’s all for now, Folks! Stay tuned for the next chapters…

Wanna learn more about Brazil, Latam and DRC in the SAP world? Subscribe to our Youtube channel!

You can also check our content by filtering TDF/ACR/DRC categories in our blog.

Want to have a consultation about a rollout to Brasil please send us an email and we’ll get back to you.

Source: https://s4cn.com/en/sap-erp-rollout-to-brazil-with-sap-s-4hana-part-1/

Nenhum comentário:

Postar um comentário